Crypto FintechZoom:ifpgc2otjig= FintechZoom – The Future of Finance!

Exploring crypto fintechzoom:ifpgc2otjig= fintechzoom was a game-changer for me. It opened doors to secure, decentralized financial solutions I never thought possible. From seamless payments to innovative tools, it’s reshaping how I manage and grow my finances.

Crypto fintechzoom:ifpgc2otjig= fintechzoom combines the power of cryptocurrency and fintech innovation to deliver secure, decentralized financial solutions. It’s transforming payments, lending, and asset management with unmatched speed and transparency.

Stay tuned with us as we dive deeper into the world of crypto fintechzoom:ifpgc2otjig= fintechzoom, exploring its latest innovations, real-world applications, and how it’s shaping the future of finance. Don’t miss out on the insights ahead.

What is Crypto FintechZoom:ifpgc2otjig= FintechZoom?

At its core, crypto fintechzoom:ifpgc2otjig= fintechzoom is a specialized subset of financial technology that leverages blockchain, cryptography, and decentralized principles to offer a new range of financial products and services.

It aims to provide more secure, transparent, and efficient systems than traditional finance, making financial services more accessible to people worldwide. This intersection enables a range of innovations, from decentralized lending platforms to new ways of managing identity and compliance in financial systems.

Historical Evolution and Technological Development!

Cryptocurrencies began with Bitcoin in 2009, introducing blockchain technology to enable decentralized transactions. This led to the rise of decentralized finance (DeFi), NFTs, and Central Bank Digital Currencies (CBDCs). DeFi platforms allow for financial services without intermediaries, while NFTs create a market for digital ownership. CBDCs are being developed to bring the benefits of blockchain to central banking.

Fintech evolved with milestones like PayPal’s launch in the 1990s, followed by the widespread adoption of mobile wallets like Apple Pay and Google Pay. Embedded finance and Banking-as-a-Service (BaaS) allowed financial services to integrate with other platforms. The COVID-19 pandemic further boosted fintech adoption as digital solutions became essential for managing finances and conducting transactions.

Read: Henry Cavill Brothers – Click Here For All The Information!

Key Features of Crypto FintechZoom – A New Financial Era!

Decentralization

Traditional financial systems rely heavily on centralized entities like banks and payment processors. However, blockchain technology, a core component of crypto fintechzoom:ifpgc2otjig= fintechzoom, allows decentralized systems where control is distributed across multiple nodes. This removes the need for intermediaries and significantly reduces costs and points of failure.

Enhanced Security Through Cryptography

Blockchain, the underlying technology of cryptocurrencies, uses cryptographic principles to secure transactions. By providing immutability and transparency, cryptography ensures that financial transactions are tamper-resistant and safe from fraud.

Transparency and Accountability

Many crypto fintechzoom:ifpgc2otjig= fintechzoom platforms utilize public ledgers, making transaction histories visible to everyone. This increases accountability in financial systems, reducing opportunities for fraud and manipulation.

Smart Contracts and Programmability

Smart contracts are self-executing contracts where the terms are written into code, allowing for automated financial transactions and agreements. These programmable contracts can automate complex financial processes such as lending, insurance claims, and decentralized finance protocols.

Interoperability Across Systems

The goal of crypto fintechzoom:ifpgc2otjig= fintechzoom is not just to build new financial products, but to create a connected ecosystem where blockchain networks can communicate with each other and with traditional financial infrastructures. This interoperability is crucial for fostering a seamless financial ecosystem.

Global Accessibility and Innovation

One of the most exciting aspects of crypto fintechzoom:ifpgc2otjig= fintechzoom is its ability to provide financial services to underserved populations around the world. The decentralized nature of the technology, combined with its low cost, offers financial inclusion to individuals without access to traditional banking services.

Key Applications of Crypto FintechZoom – Lending & Borrowing!

Decentralized Lending & Borrowing:

- Lower Costs: By cutting out intermediaries, borrowing is more affordable.

- Higher Returns: Lenders can earn more from digital asset-backed loans.

- Wider Access: Provides financial services to those without traditional banking access.

- Efficiency: Smart contracts automate and secure the entire process.

Cross-Border Payments & Remittances:

- Reduced Fees: Blockchain reduces middlemen, making payments cheaper.

- Faster Transactions: Cross-border transfers are nearly instant.

- Greater Transparency: Transactions are publicly recorded, ensuring accountability.

Decentralized Exchanges (DEXs):

- Privacy: DEXs allow users to trade more privately than centralized platforms.

- Increased Security: No central server means a lower risk of hacking.

- Direct Trading: Users trade directly with each other, avoiding intermediaries.

Tokenization of Real-World Assets:

- Fractional Ownership: Tokenization allows people to own fractions of assets like real estate or art.

- Liquidity: It enables quicker, more liquid markets for traditionally illiquid assets.

Identity Management & KYC/AML Compliance:

- Self-Sovereign Identity: Users control their personal data while complying with regulations.

- Enhanced Security: Blockchain ensures secure, tamper-proof identity management.

Read: Lekulent Movies – Your Gateway to Free Entertainment!

How does Crypto FintechZoom enhance security in financial transactions?

Crypto FintechZoom enhances security in financial transactions by using blockchain and encryption. Blockchain creates a secure, transparent ledger where every transaction is recorded and can’t be changed, reducing fraud risks. Encryption protects sensitive information, making it nearly impossible for hackers to access or alter data.

Additionally, smart contracts automatically execute transactions based on pre-set rules, ensuring accuracy and reducing human error. Together, these technologies provide a highly secure way to conduct financial transactions without the need for intermediaries

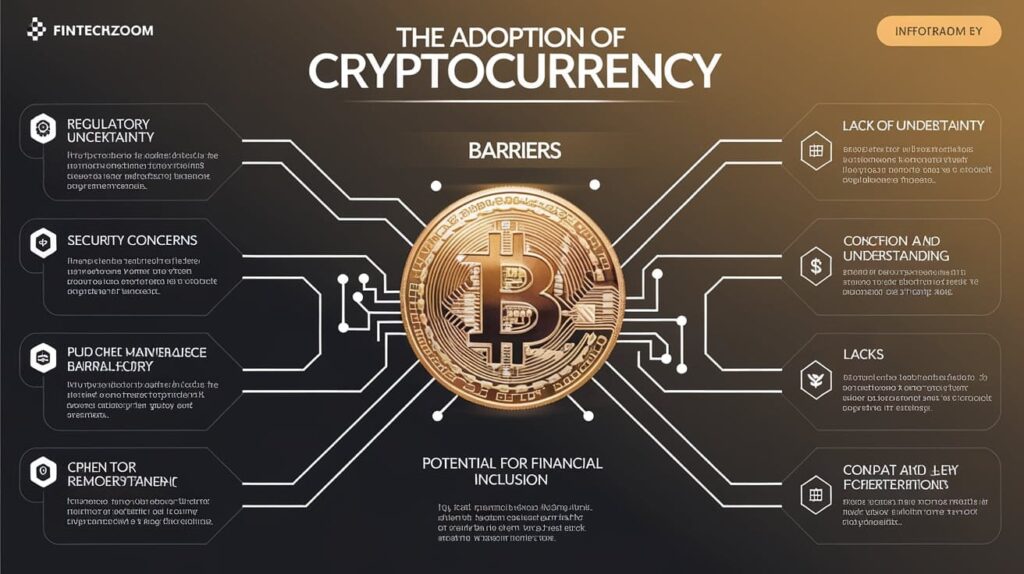

Crypto FintechZoom Adoption – Key Barriers You Need to Know!

The adoption of Crypto FintechZoom faces several significant challenges, from regulatory uncertainty to scalability issues. Governments around the world are still working to define frameworks for integrating crypto with traditional financial systems, creating a complex legal landscape.

Additionally, scalability remains a hurdle, as blockchain networks struggle with high transaction volumes. User experience can also be a barrier, with many platforms being difficult for the average person to navigate.Additionally, market volatility and security concerns create risks for users and investors, hindering widespread adoption.

Regulatory Uncertainty

The regulatory landscape for cryptocurrency and fintech is still evolving. Governments and regulatory bodies around the world are working to define frameworks that can safely integrate crypto fintechzoom:ifpgc2otjig= fintechzoom solutions into traditional financial systems.

Scalability Issues

Blockchain networks like Ethereum face scalability challenges, especially during periods of high demand. Solutions like layer-2 scaling protocols are being developed to address these issues and improve transaction throughput.

User Experience Challenges

Many crypto fintechzoom:ifpgc2otjig= fintechzoom applications can be complex for the average user. Improving user interfaces and making the technology more accessible are crucial for mass adoption.

Read: 6 Reasons To Get an Attorney Before Contacting Insurance After an Accident

FAQs:

What is Crypto FintechZoom?

Crypto FintechZoom is the convergence of cryptocurrency and financial technology, combining blockchain principles and innovative fintech solutions. It focuses on decentralization, enhanced

security, and faster financial services through technologies like smart contracts and cryptocurrencies.

How does Crypto FintechZoom differ from traditional finance?

Crypto FintechZoom operates without a central authority, using decentralized technologies like blockchain. Unlike traditional finance, it reduces reliance on intermediaries, offers faster transactions, and enhances transparency and security.

What are the main benefits of Crypto FintechZoom?

Some key benefits include lower transaction costs, increased security through blockchain, global accessibility, and transparency. It also enables innovation in services such as decentralized lending, cross-border payments, and asset tokenization.

What challenges does Crypto FintechZoom face?

Challenges include regulatory uncertainty, scalability issues, user experience barriers, volatility, and interoperability between different blockchain networks. Additionally, there are concerns about energy consumption in some blockchain protocols.

How will Crypto FintechZoom shape the future of finance?

As the technology evolves, we expect increased institutional adoption, greater integration with AI and IoT, improved privacy features, and sustainable practices. Crypto FintechZoom is poised to revolutionize financial systems by enabling decentralized finance (DeFi) and creating new asset classes.

What role does blockchain play in Crypto FintechZoom?

Blockchain is the backbone of Crypto FintechZoom. It enables secure, transparent, and decentralized systems by recording transactions in an immutable public ledger. It allows innovations like smart contracts, decentralized applications (dApps), and asset tokenization.

Can Crypto FintechZoom be used for cross-border payments?

Yes, Crypto FintechZoom can significantly enhance cross-border payments by reducing transaction fees, increasing speed, and offering greater transparency. Blockchain and cryptocurrency networks enable near-instantaneous settlements, minimizing exchange rate risks and improving accessibility.

Conclusion:

Crypto FintechZoom is revolutionizing the future of finance by combining cryptocurrency and financial technology. It offers enhanced security, lower costs, and greater accessibility, paving the way for decentralized systems that are efficient and transparent. While challenges like regulatory uncertainty and scalability remain, advancements in blockchain and fintech will overcome these hurdles.

As Crypto FintechZoom continues to evolve, it promises a more inclusive, sustainable, and streamlined financial landscape.

Read: